child tax credit 2021 dates irs

Get the up-to-date data and facts from USAFacts a nonpartisan source. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started.

Child Tax Credit Schedule 8812 H R Block

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

. File a federal return to claim your child tax credit. 3600 for children ages 5 and. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child tax credit payment for Nov. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month.

The IRS urges taxpayers. The IRS will soon allow claimants to adjust their. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

For both age groups the rest of the. It provides information about the Child Tax Credit and the monthly advance payments made from July. The IRS bases your childs eligibility on their age on Dec.

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit to parents of children up to age five.

Child tax credit 2021 payment dates Saturday June 18 2022 Edit. Half of the total will be paid as six monthly payments and half as a 2021 tax credit. For more information regarding.

After that payments will be disbursed on a monthly basis through December 2021. 2021 Advance Child Tax Credit Payments start July 15 2021 IRSgovchildtaxcredit2021 Eligible families can receive advance payments of up to 300 per monthfor each child under age 6 and. IR-2021-153 July 15 2021.

6 Tax Credits You Can Claim In. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. The IRS has confirmed that theyll.

Enter your information on Schedule 8812 Form. In january 2022 the irs will send. For both age groups the rest of the.

The IRS will make a one-time payment of 500 for dependents age 18 or full-time college. 1 day agoHawaii tax rebate check. The IRS will send Letter 6419 in January of 2022 to provide the total amount of advance Child Tax Credit payments that were received in 2021.

The IRS will begin disbursing advance Child Tax Credit payments on July 15. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments.

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs Taxes. If parents dont do this they will be able to. The number one use of the child tax credit payments.

Kc3E62Nwwh W7M Child Tax Credit Payments Are Over But You Could. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The IRS said it will update its Child Tax Credit Update Portal later this year to allow parents to register children born or adopted in 2021.

The fourth payment date is Friday October 15 with the IRS sending most of the checks. Simple or complex always free. Understand that the credit does not affect their federal benefits.

Ad Discover trends and view interactive analysis of child care and early education in the US. Get your advance payments total and number of qualifying children in your online account. The IRS will soon allow claimants to adjust their.

The Michigan mother of three including a son with autism. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021. 3600 for children ages 5 and under at the end of 2021.

Irs started child tax credit ctc portal to get advance payments of 2021 taxes. 3000 for children ages 6. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Residents who earned under 100000 in 2021 will get a 300 tax rebate this year with dependents eligible for the rebate as well. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. To reconcile advance payments on your 2021 return.

The JCT has made. The IRS bases your childs eligibility on their age on Dec. The advance Child Tax Credit.

That comes out to 300 per month through the. IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and.

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kabb

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Child Tax Credit Payments Start July 15

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

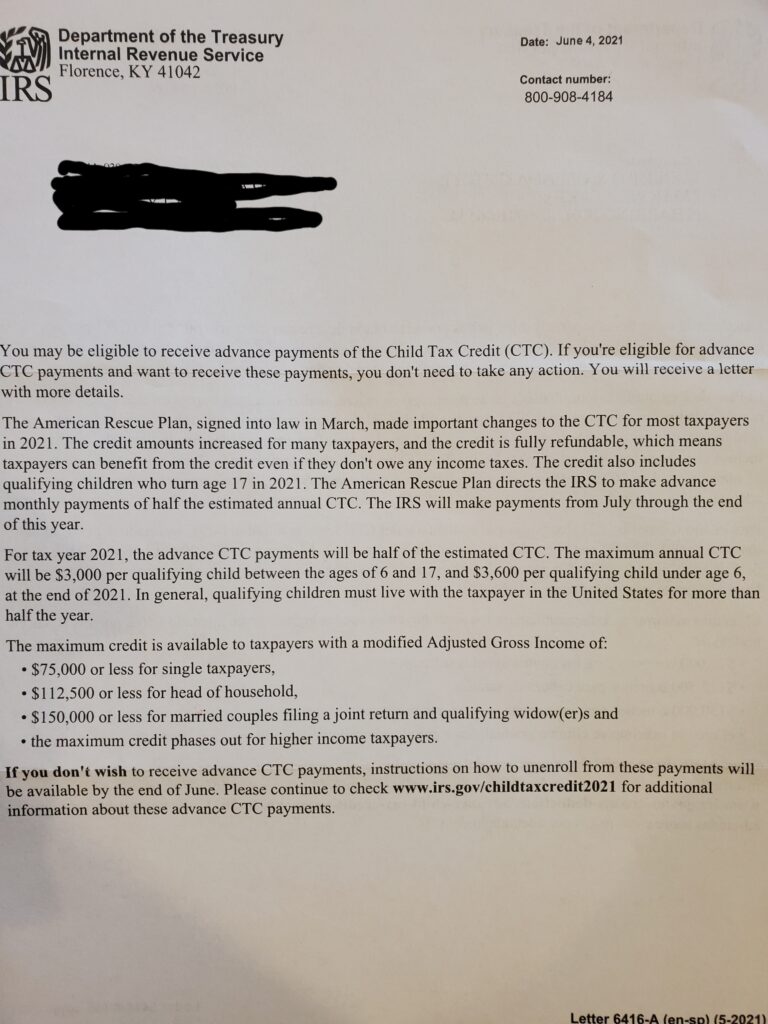

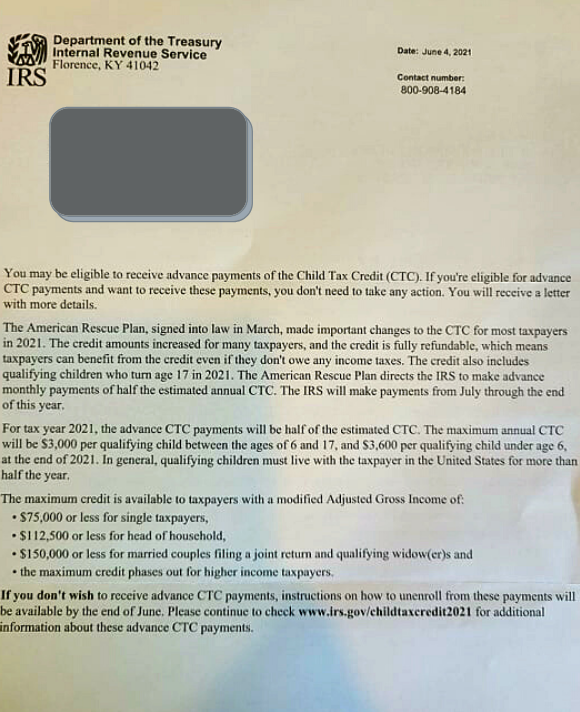

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

How The New Expanded Federal Child Tax Credit Will Work

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2021 Changes Grass Roots Taxes

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit Irs Unveils Address Change Feature For September Payment